Country Profiles

|

|

|

|

|

|

Oman

The Sultanate of Oman is on the southeastern coast of the Arabian Peninsula. It shares land borders with Saudi Arabia, the United Arab Emirates, and Yemen. The coast faces the Arabian Sea on the southeast, and the Gulf of Oman on the northeast. It has a number of smallish exclaves within the United Arab Emirate’s land borders. The capital and largest city is Muscat.

Maps & Flag

Of Oman’s total population of 5.2 million, just over half are Omani citizens (2.9 million, 57 per cent).

Introduction

Under its “Vision 2040 development plan,” the Sultanate of Oman is “determined to diversify its income sources and achieve sustainable development” (World Bank, 2024a). [1] The expansion of nonhydrocarbon activities has helped supporting economic activity despite OPEC+ oil production cuts, notably in construction, manufacturing, and services. In a summary, the World Bank (2024a) write:

Economic activity continues to perform well despite OPEC+ oil production cuts, driven by the expansion of non-hydrocarbon activities, notably in construction, manufacturing, and services, but fiscal revenues and exports proceeds remain tied to oil market developments. However, a commitment to economic diversification continues to shore up fiscal and external positions, keeping them in surplus over the medium term. Employment growth is driven by female employment, which is estimated to increase twice the rate observed among men. Downside risks to the outlook include oil market volatility, climate change risks, and potential spillovers from the escalating of conflict in the Middle East.

The utilisation of windfall savings to reduce public debt in 2023 was an important step to bring it down by almost a half of its peak of nearly 68 per cent of GDP in 2020, thereby improving Oman’s credit rating, but more efforts are needed to decouple fiscal revenue from oil proceeds. In January 2024, Oman Investment Authority launched the “Future Fund Oman,” worth £4.2 billion (US$5.2bn), to invest in a wide range of industries, attract foreign direct investment (FDI) , and support the private sector over the next five years, mainly in tourism, manufacturing, green energy, and logistics, among other. The new social protection law, which has become effective in January 2024, introduced a range of non-contributory social benefits, underscoring Oman’s commitment to supporting its vulnerable population despite its increased fiscal burden. In addition, a series of new measures were announced in July 2024 to regulate the labour market and boost private-sector employment among nationals. Key measures include adding 30 new professions to the list of jobs reserved for Omani citizens and providing financial incentives to companies hiring Omanis, with potential government contributions to salaries.

Political-Economy

Oman’s overall score in EIU’s 2023 Democracy Index was 3.12 (out of ten) in 2023 ranking it 119th out of 167 economies. Oman’s score remains around the median for GCC countries, below Qatar’s and Kuwait’s but above those of the UAE, Bahrain and Saudi Arabia. The EIU classify it as remains classified as an “authoritarian.”

According to RSF (2024) media self-censorship is the rule in the “peaceful sultanate” of Oman, where “criticism of Sultan Haitham bin Tariq or his cousin and predecessor, Qabus ibn Said, are unacceptable.” Between 2016 and 2021, political pressure forced the few independent and critical newspapers, Azamn and Al-Balad, and the online magazine Muwatin, to shut down. Omani journalism is marked by overwhelmingly positive coverage that aims to deliver a glowing image of the country. Any form of criticism is frowned upon. It is further said that bloggers and journalists are frequently arrested, sometimes detained in secret and sentenced to prison on charges including insulting the head of state, or the country’s culture or traditions, inciting illegal demonstrations, or disturbing public order. Advocating for environmental protection or the safeguarding of nature reserves is also considered to be mostly off-limits for journalists.

RSF (2024) also state that in Oman, most media are financed by government advertising. The government regularly organises press tours and even hosts events that promote journalism, which are opportunities to invite media professionals from all over the world. These events serve to publicise the sultanate’s history and culture and to present its economic development strategy plan: “Vision 2040.”

Freedom House (2024) write that “Oman is a hereditary monarchy, and power is concentrated in the hands of the sultan.” Furthermore, Oman’s government “restricts virtually all political rights and civil liberties, imposing criminal penalties for criticism and dissent.” Interestingly, demonstrations in support of Palestine that took place in several Omani cities since Israel’s war on Gaza were not being broken up by security forces.

Oman has a new social protection law that paves the way for a universal social security system according to Human Rights Watch (2024). The NGO state that if effectively and fairly implemented, “this law could realize socioeconomic rights of Omani nationals and residents, including migrant workers, who are facing events that substantially affect their income.” Interestingly, the new system is scheduled to include a monthly universal, rather than means-tested, child benefit to every family per child, an entitlement for people aged 60 and older, a disability allowance in family income support, and support for widows and orphans. That being said, Human Rights Watch (2024) also state the following:

Oman’s overly broad laws restrict the rights to freedom of expression, assembly and association. The authorities target peaceful activists, pro-reform bloggers, and government critics using short term arrests and detentions and other forms of harassment. Although the law states that all citizens are equal and bans gender-based discrimination, women face discrimination under the law in matters of divorce, inheritance, child custody and legal guardianship. Oman’s kafala (labour sponsorship) system and lack of labor law protections leaves the country’s more than 140,000 migrant domestic workers exposed to abuse and exploitation by employers.

Graphs & Tables

What follows are a selection of graphs and tables, focused on Oman, from credible and cited sources. It is worth comparing the data presented here with those of the other Arabian Gulf countries.

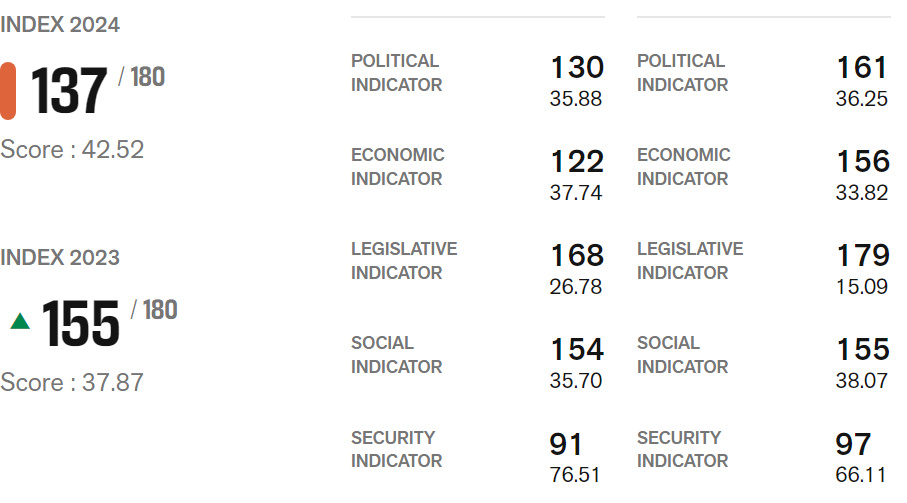

RSF contend that it is the right of every human being to “have access to free and reliable information.” The Press Freedom Index, use five contextual indicators for each economy assessed: political context, legal framework, economic context, sociocultural context and safety (whereby a subsidiary score ranging from 0 to 100 is calculated for each indicator):

Oman, Press Freedom scores

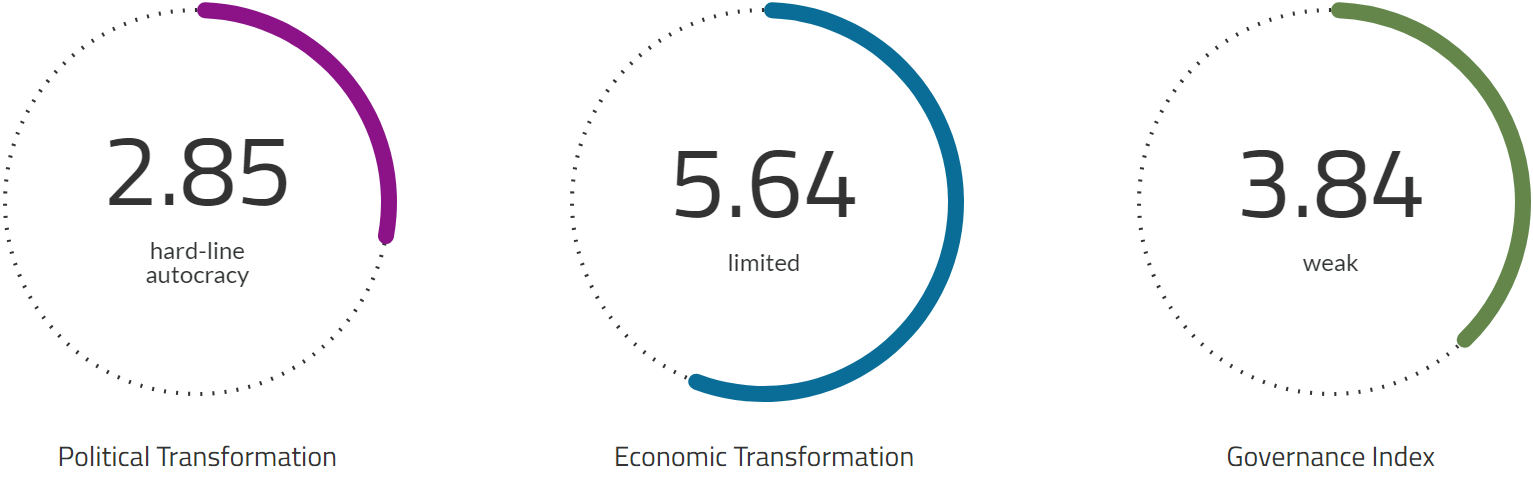

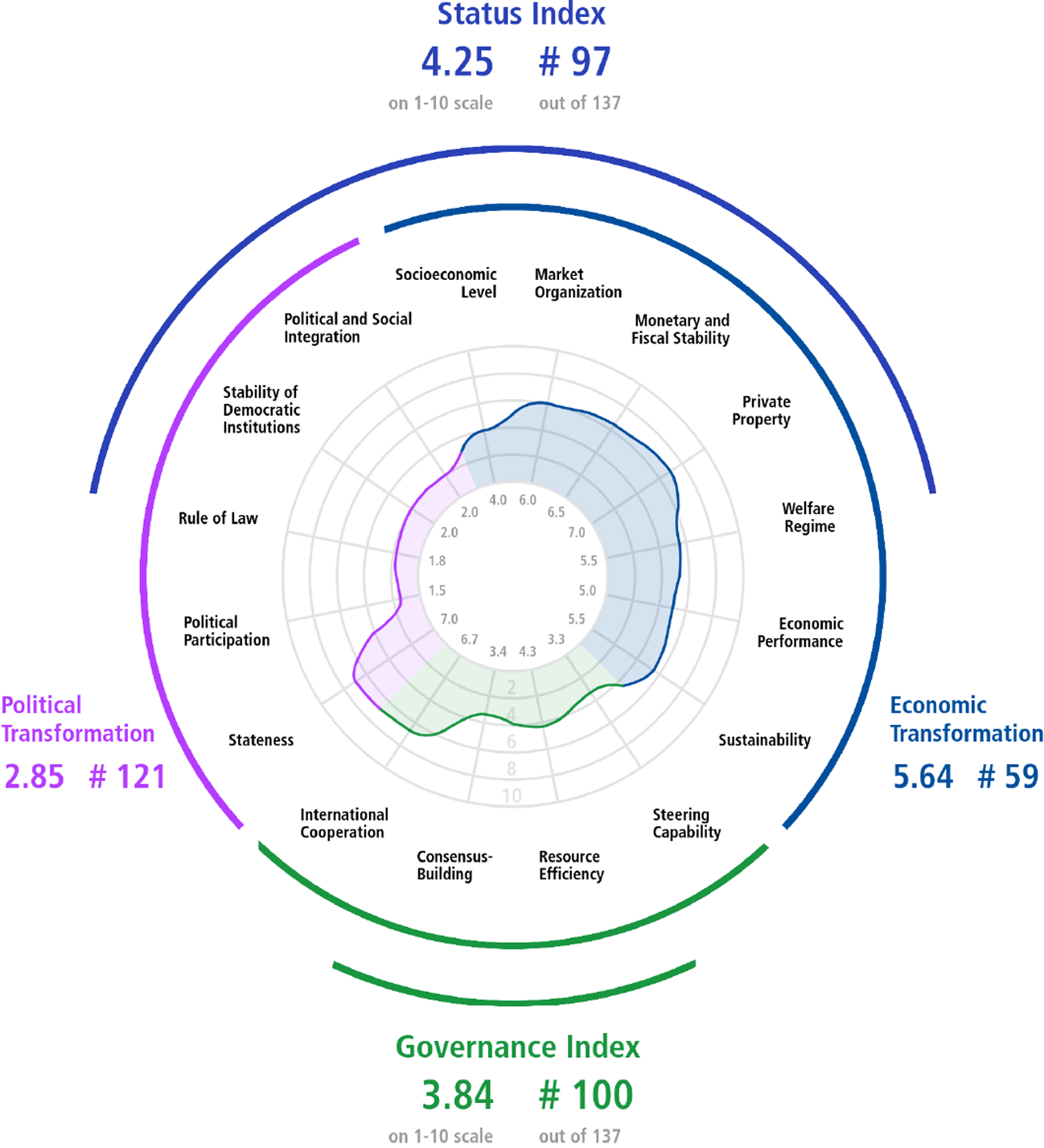

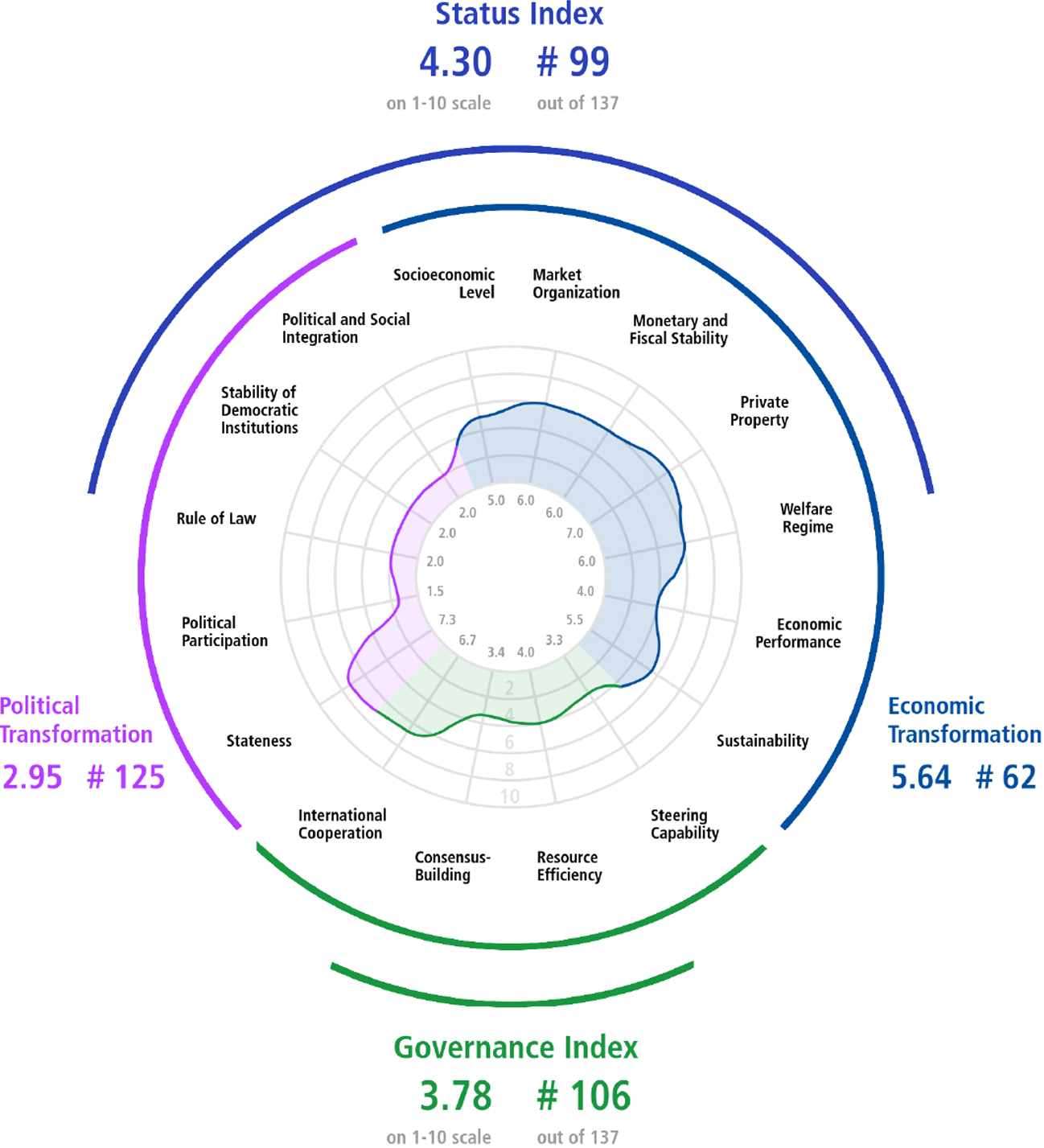

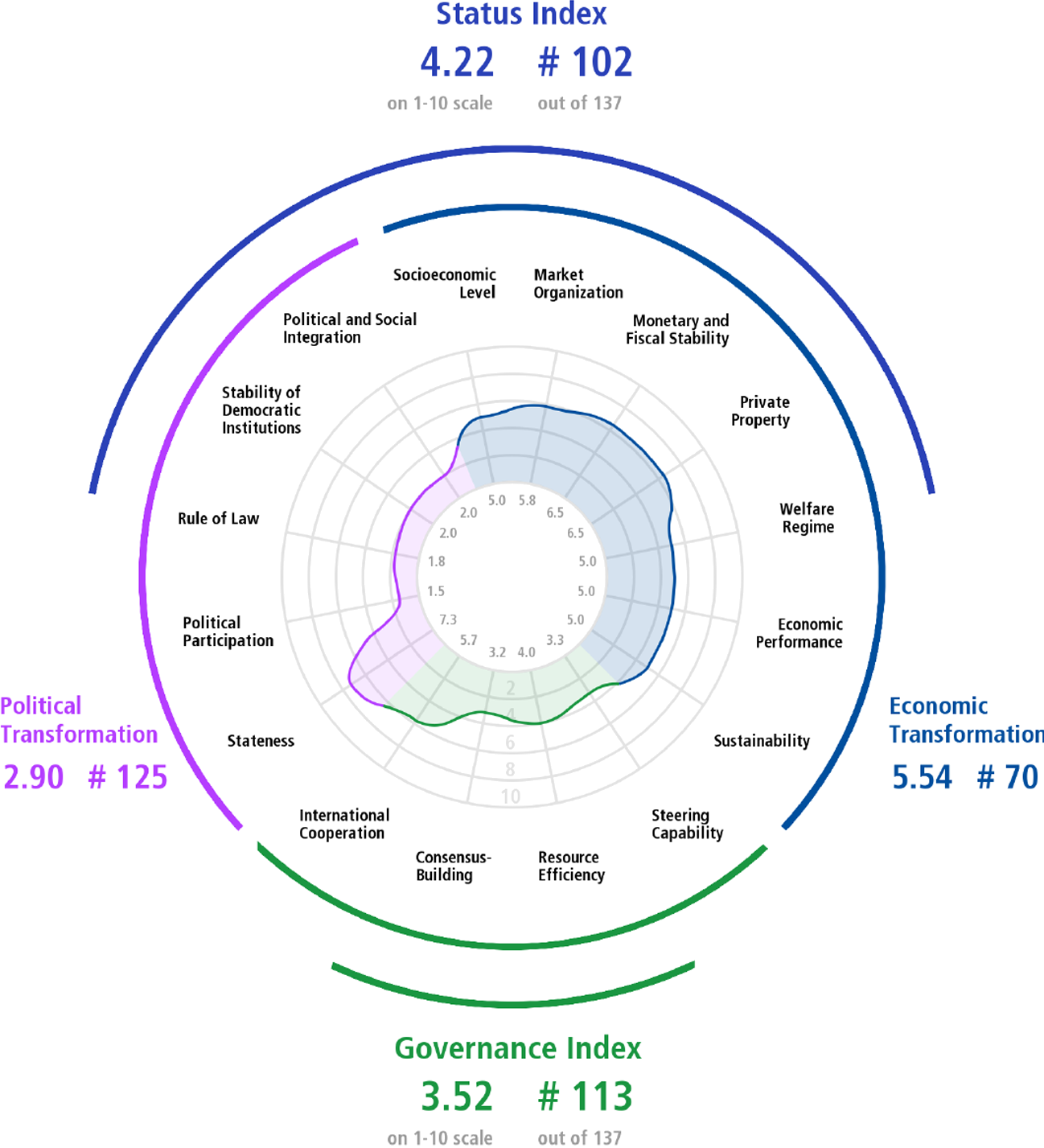

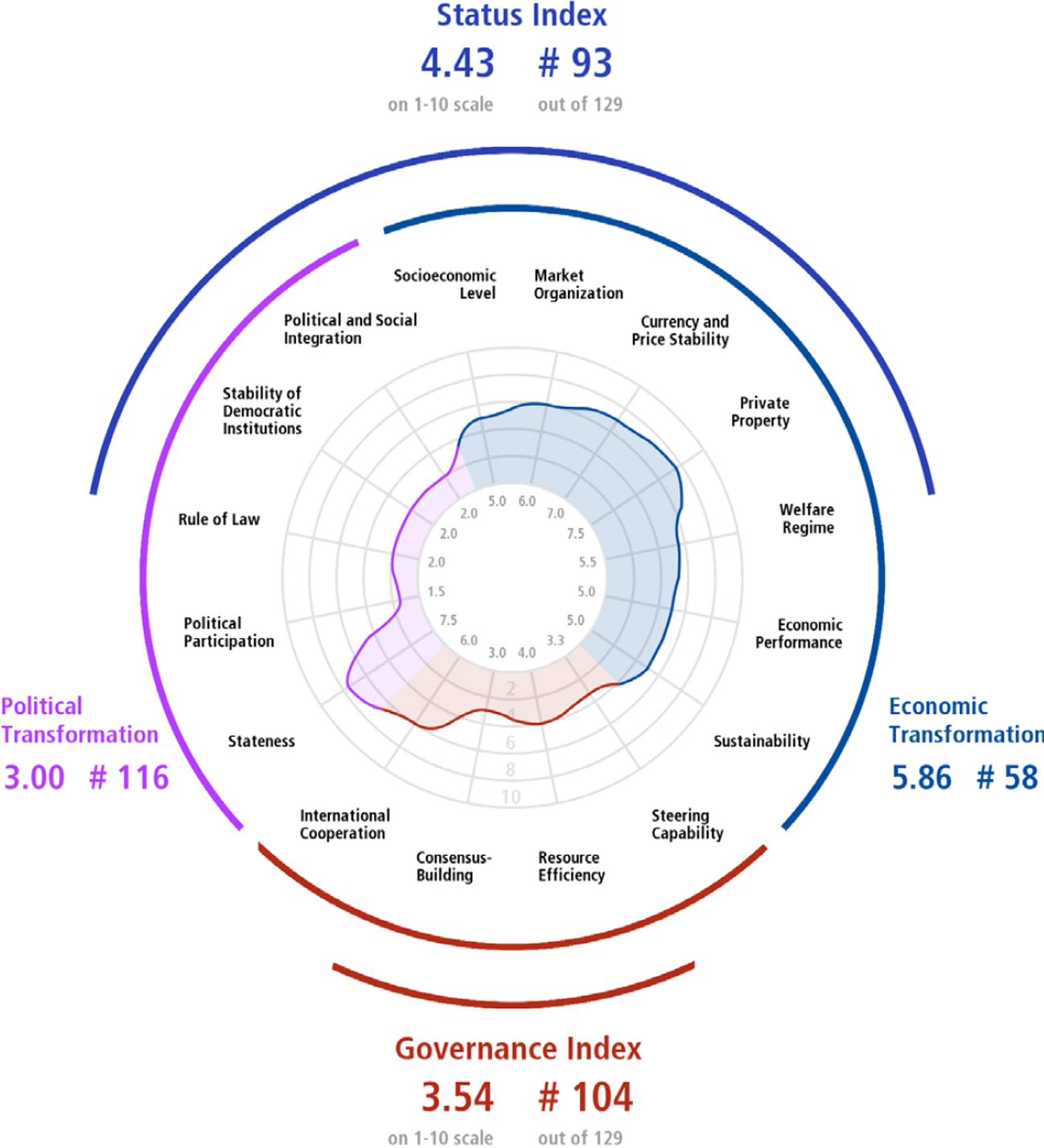

Bertelsmann Stiftung’s Transformation Index analyses the transformation processes toward democracy in transitional economies across the globe. In 2024 it was stated that throughout MENA, “autocratic rule festers” and that MENA’s scores for democracy and the quality of governance are at “all-time lows” and that “the quality of governance is deteriorating, and military forces are gaining power.” The German Non-governmental organisation adds that many countries within this region on “flashy imagery and marketing under the banner of modernisation, rather than making actual progress (BTI, 2024).

Oman’s 2024 BTI scores

Expand Chart →

Oman’s 2024 BTI matrix:

Oman’s 2022 BTI matrix:

Oman’s 2020 BTI matrix:

Oman’s 2018 BTI matrix:

Fraser Institute rankings

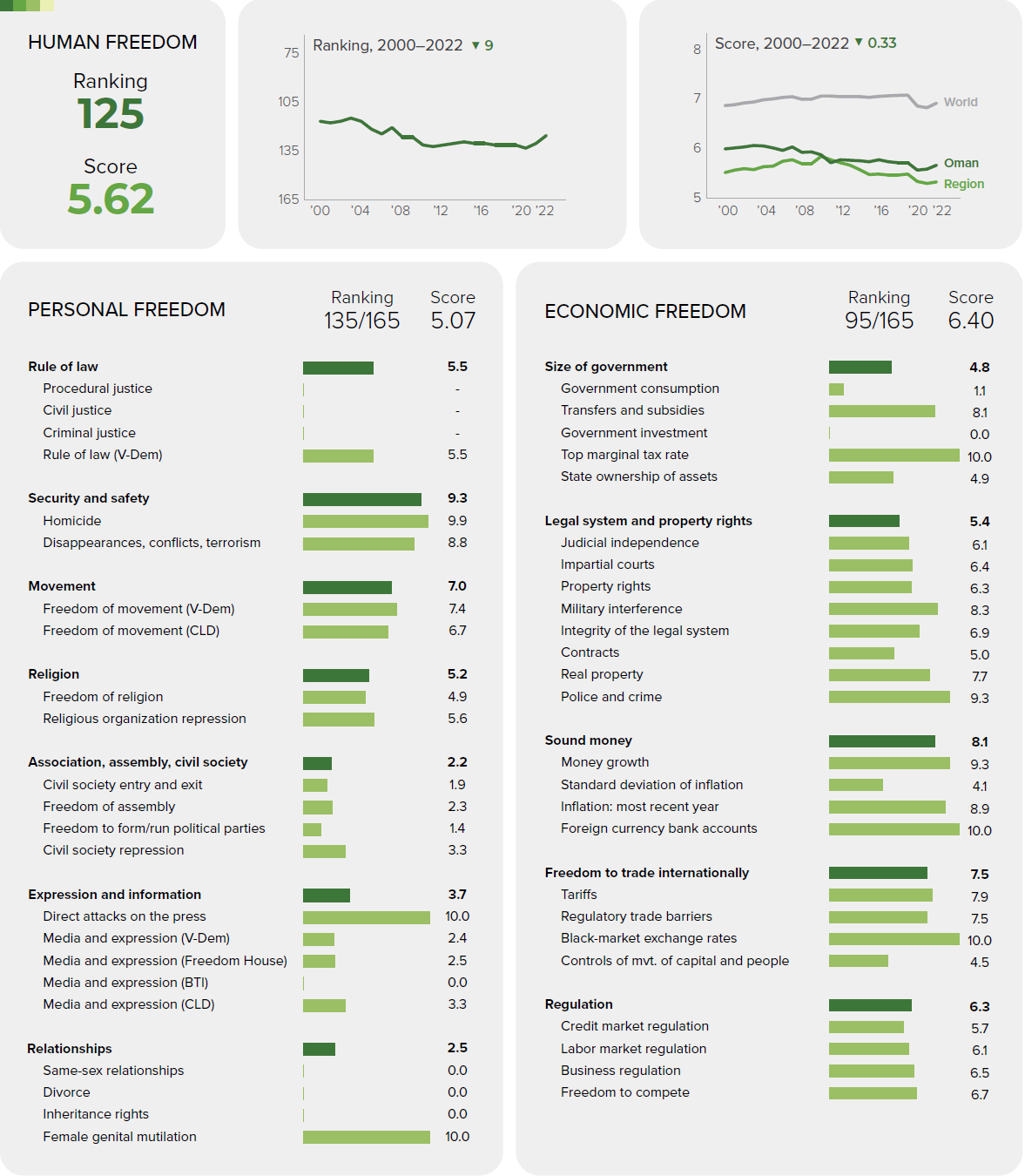

The Fraser Institute’s Human Freedom Index presents a broad measure of human freedom, understood as the absence of coercive constraint.

Oman, Human Freedom Index, 2024 scores

Freedom House rankings

Freedom House point out that their Freedom in the World annual rankings are “the most widely read and cited report of its kind, tracking global trends in political rights and civil liberties for over 50 years.” They chart Global Freedom scores and Internet Freedom scores for some 210 countries and territories. More latterly, Freedom House have begun to chart Internet Freedom scores (currently 70 countries are tracked, of which three are in the Arabian Gulf: Bahrain, Saudi Arabia and the United Arab Emirates).

Oman, Freedom in the World, 2024 scores

notes

Country profile information is compiled from, amongst others, the following sources; a full References list for this page is also given below:

Academic

Cambridge University Press →

Cambridge University Press →

Intellect Discover →

Intellect Discover →

Oxford Academic →

Oxford Academic →

Routledge →

Routledge →

Sage →

Sage →

Springer →

Springer →

Media outlets

The Economist Intelligence Unit →

The Economist Intelligence Unit →

Financial Times →

Financial Times →

Middle East Economic Digest →

Middle East Economic Digest →

Organisations

Arab Monetary Fund →

Arab Monetary Fund →

Bertelsmann Transformation Index →

Bertelsmann Transformation Index →

Energy Information Agency →

Energy Information Agency →

Energy Institute →

Energy Institute →

Eurostat →

Eurostat →

Fraser Institute →

Fraser Institute →

Freedom House →

Freedom House →

International Energy Agency →

International Energy Agency →

International Monetary Fund →

International Monetary Fund →

Organisation of Petroleum Exporting Countries →

Organisation of Petroleum Exporting Countries →

Organisation for Economic Co-operation and Development →

Organisation for Economic Co-operation and Development →

Reporters sans frontières →

Reporters sans frontières →

United Nations Development Program →

United Nations Development Program →

Varieties of Democracy →

Varieties of Democracy →

The World Bank →

The World Bank →

World Economic Forum →

World Economic Forum →

World Intellectual Property Organisation →

World Intellectual Property Organisation →

World Trade Organisation →

World Trade Organisation →

References

Al Shouk, A. (2024, June 20). Emiratisation deadline looms as larger private companies look to fulfil national targets. The National. https://www.thenationalnews.com/news/uae/2024/06/20/emiratisation-deadline-july/

Arab Monetary Fund. (2025). Economic Statistics [Dataset]. https://www.amf.org.ae/en/arabic_economic_database

Asker, J., Collard-Wexler, A., & De Loecker, J. (2017). Market power, production (mis)allocation and OPEC. National Bureau of Economic Research, Working Paper Series, 1(September, w23801), 1–54. https://doi.org/10.3386/w23801

Assidmi, L. M., & Wolgamuth, E. (2017). Uncovering the Dynamics of the Saudi Youth Unemployment Crisis. Systemic practice and action research, 30(2), 173–186. https://doi.org/10.1007/s11213-016-9389-0

Baumeister, C., & Kilian, L. (2016). Forty Years of Oil Price Fluctuations: Why the Price of Oil May Still Surprise Us. The Journal of Economic Perspectives, 30(1), 139–160. https://doi.org/10.1257/jep.30.1.139

Bekhradnia, B. (2016). International university rankings: For good or ill? Higher Education Policy Institute, 1(89), 1–32.

Benítez-Márquez, M.-D., Sánchez-Teba, E. M., Coronado-Maldonado, I., & Sung, W.-W. (2022). An alternative index to the global competitiveness index. PloS one, 17(3), 1–19. https://doi.org/10.1371/journal.pone.0265045

Bertelsmann Stiftung. (2024). BTI 2004-2024 Country Reports [Dataset: Bertelsmann Transformation Index]. https://bti-project.org/en/reports/global-dashboard

BP. (2022). Statistical Review of World Energy. British Petroleum.

Bradshaw, T. (2022). [Book Review] Davidson, C. “From Sheikhs to Sultanism: Statecraft and Authority in Saudi Arabia and the UAE”. Middle Eastern Studies, 58(1), 687–688. https://doi.org/10.1080/00263206.2021.2017288

Caldara, D., Cavallo, M., & Iacoviello, M. (2019). Oil price elasticities and oil price fluctuations. Journal of Monetary Economics, 103(May), 1–20. https://doi.org/10.1016/j.jmoneco.2018.08.004

Chirikov, I. (2023). Does conflict of interest distort global university rankings? Higher Education, 86(4), 791–808. https://doi.org/10.1007/s10734-022-00942-5

Cooley, A., & Snyder, J. (Eds.). (2015). Ranking the World: Grading States as a Tool of Global Governance. Cambridge University Press.

Cortés, P., Kasoolu, S., & Pan, C. (2023). Labor Market Nationalization Policies and Exporting Firm Outcomes: Evidence from Saudi Arabia. Economic development and cultural change, 71(4), 1397–1426. https://doi.org/10.1086/719835

EIA. (2024). International, Petroleum and other liquids [Dataset: U.S. Energy Information Administration]. https://www.eia.gov/international/data/

EIA. (2025). Real Petroleum Prices [Dataset: Energy Information Agency]. https://www.eia.gov/outlooks/steo/realprices/

EIU. (2024). Democracy Index 2023: Age of conflict. Economist Intelligence Unit. https://www.eiu.com/n/campaigns/democracy-index-2023/

EIU. (2025). EIU Democracy Indices, 2018-2023 [Dataset: EIU Democracy Indices]. Economist Intelligence Unit.

Energy Institute. (2024). Statistical Review of World Energy [Dataset]. https://www.energyinst.org/statistical-review/resources-and-data-downloads

Eurostat. (2025). Database [Dataset]. https://ec.europa.eu/eurostat/data/database

Fraser Institute. (2024). The Human Freedom Index. The Fraser Institute.

Freedom House. (2024a). Freedom on the Net [Dataset]. https://freedomhouse.org/countries/freedom-net/scores

Freedom House. (2024b). World Freedom Index [Dataset]. https://freedomhouse.org/report/freedom-world#Data

Global Media Insight. (2024). UAE Population 2024 (Key Statistics). Global Media Insight. https://www.globalmediainsight.com/blog/uae-population-statistics/

Global SWF. (2024). Countries Ranking [Dataset]. https://globalswf.com/countries

Government of Bahrain. (2024). The National Labour Market Plan 2023-2026. Labour Market Regulatory Authority.

Government of Bahrain. (2025). Open Data Portal [Dataset]. Information & eGovernment Authority. https://www.data.gov.bh/

Government of Dubai. (2022). Number of Population Estimated by Nationality [Dataset]. https://www.dsc.gov.ae/en-us/Themes/Pages/Population-and-Vital-Statistics.aspx?Theme=42

Government of Kuwait. (2018). Decent Work: Country Programme For Kuwait. Government of Kuwait.

Government of Kuwait. (2024). Labour Market Statistics [Dataset: Central Statistical Bureau]. https://www.csb.gov.kw/Pages/Statistics_en?ID=64&ParentCatID=1

Government of Kuwait. (2025). Open Data [Dataset]. https://e.gov.kw/sites/kgoenglish/Pages/OtherTopics/OpenData.aspx

Government of Oman. (2022). Skills needs in the Oman labour market: An employer survey. Oman Chamber of Commerce and Industry.

Government of Oman. (2025). Population statistics [Dataset: National Centre For Statistics & Information]. https://data.gov.om/

Government of Qatar. (2025). Open Data Portal [Dataset: Planning and Statistics Authority]. https://www.data.gov.qa

Government of Saudi Arabia. (2024). Labour Market Statistics [Dataset: General Authority for Statistics]. https://www.stats.gov.sa/en/814

Government of the United Arab Emirates. (2025). Open Data [Dataset]. Ministry of Economy. https://www.moec.gov.ae/en/open-data

Gulf Research Centre. (2024). Gulf Labour Markets, Migration and Population programme [Dataset]. https://gulfmigration.grc.net/

Gunitsky, S. (2015, June 23). How do you measure ‘democracy’? The Washington Post. https://www.washingtonpost.com/news/monkey-cage/wp/2015/06/23/how-do-you-measure-democracy/

Hazelkorn, E. (2019). University Rankings: there is room for error and “malpractice”. Elephant in the Lab. https://doi.org/10.5281/zenodo.2592196

Herre, B. (2024). Democracy data: how sources differ and when to use which one. OurWorldinData.org. https://ourworldindata.org/democracies-measurement

Hertog, S. (2018). Can we Saudize the labour market without damaging the private sector? Retrieved from http://eprints.lse.ac.uk/id/eprint/101471

Hertog, S. (2024). The Political Economy of Reforms under Vision 2030. In J. Sfakianakis (Ed.), The Economy of Saudi Arabia in the 21st Century: Prospects and Realities (pp. 359–380). Oxford University Press.

IEA. (2025). Data and statistics [Dataset: The International Energy Agency]. https://www.iea.org/data-and-statistics/data-sets

Ikenberry, G. J. (2015). Ranking the World: Grading States as a Tool of Global Governance [Book Review]. Foreign Affairs, 94(5), 180–180. https://www.jstor.org/stable/24483753

IMF. (2023). Kuwait: 2023 Article IV Consultation. IMF Staff Country Reports, 2023(331). https://doi.org/10.5089/9798400254680.002

IMF. (2024a). Gulf Cooperation Council: Pursuing Visions Amid Geopolitical Turbulence. International Monetary Fund working papers, 2024(66), 1–74. https://doi.org/10.5089/9798400295744.007

IMF. (2024b). Qatar: 2023 Article IV Consultation. IMF Country Report, 2024(24/43). https://www.imf.org/en/Publications/CR/Issues/2024/02/06/Qatar-2023-Article-IV-Consultation-Press-Release-and-Staff-Report-544471

IMF. (2024c). Saudi Arabia: 2024 Article IV Consultation. IMF Staff Country Reports, 2024(323). https://doi.org/10.5089/9798400252099.002

IMF. (2024d). United Arab Emirates: 2024 Article IV Consultation. IMF Staff Country Reports, 2024(325). https://doi.org/10.5089/9798400293245.002

IMF. (2024e). World Economic Outlook [Dataset]. https://www.imf.org/en/Publications/WEO/weo-database/2024/April

IMF. (2025). Oman: 2024 Article IV Consultation. IMF Staff Country Reports, 2025(13). https://doi.org/10.5089/9798400298318.002

Kashyap, A. K., & Kovrijnykh, N. (2016). Who Should Pay for Credit Ratings and How? The Review of financial studies, 29(2), 420–456. https://doi.org/10.1093/rfs/hhv127

Lopesciolo, M., Muhaj, D., & Pan, C. (2021). The quest for increased Saudization: Labor market outcomes and the shadow price of workforce nationalisation policies. Retrieved from https://growthlab.hks.harvard.edu/publications/quest-increased-saudization-labor-market-outcomes-and-shadow-price-workforce

Nair, D. (2024, May 13). What roles are Emiratis being hired for in the private sector? The National. https://www.thenationalnews.com/business/money/2024/05/13/emiratis-hired/

OECD. (2025). OECD Data Explorer [Dataset]. https://www.oecd.org/en/data/datasets/oecd-DE.html

OPEC. (2024). Annual Statistical Bulletin. Organisation of the Petroleum Exporting Countries.

Polity IV. (2018). Political Regime Characteristics and Transitions, 1800–2018 [Dataset: Center for Systemic Peace]. http://www.systemicpeace.org/inscr/p4v2018.xls

Poplavskaya, A., Karabchuk, T., & Shomotova, A. (2023). Unemployment Challenge and Labor Market Participation of Arab Gulf Youth: A Case Study of the UAE. In M. M. Rahman & A. Al-Azm (Eds.), Social Change in the Gulf Region: Multidisciplinary Perspectives (pp. 511–529). Springer Nature Singapore.

Porter, M. E. (1998). Competitive Advantage of Nations. Simon & Schuster.

Reporters Without Borders. (2024). Press Freedom Index [Dataset: Press Freedom Index]. https://rsf.org/en/index

Rutledge, E. J., & Al Kaabi, K. (2023). ‘Private sector’ Emiratisation: social stigma’s impact on continuance intentions. Human Resource Development International, 26(5), 603–626. https://10.1080/13678868.2023.2182097

Shore, C. (2018). How Corrupt Are Universities? Audit Culture, Fraud Prevention, and the Big Four Accountancy Firms. Current Anthropology, 59(18), 92–104. https://doi.org/10.1086/695833

The Economist. (2020, May 7). Credit-rating agencies are back under the spotlight. The Economist. Retrieved from https://www.economist.com/finance-and-economics/2020/05/07/credit-rating-agencies-are-back-under-the-spotlight

The Times of Kuwait. (2024, August 24). Kuwaiti workforce grows to 457,567. The Times of Kuwait. https://timeskuwait.com/kuwaiti-workforce-grows-to-457567-makes-up-21-3-of-labor-market/

UNDP. (2024). Human Development Index [Dataset: The United Nations Development Program]. https://hdr.undp.org/data-center

UNDP. (2025). Human Development Index (HDI). The United Nations Development Program. https://hdr.undp.org/data-center/human-development-index#/indicies/HDI

V-Dem. (2024). V-Dem [Dataset: University of Gothenburg, Department of Political Science]. https://doi.org/10.23696/mcwt-fr58

Vaccaro, A. (2021). Comparing measures of democracy: statistical properties, convergence, and interchangeability. European political science, 20(4), 666–684. https://doi.org/10.1057/s41304-021-00328-8

WEF. (2019). The Global Competitiveness Indices. The World Economic Forum. https://www3.weforum.org/docs/WEF_TheGlobalCompetitivenessReport2019.pdf

WEF. (2025). The Global Competitiveness Indices, 2008–2019 [Dataset: Global Competitiveness Indices]. The World Economic Forum. https://www.weforum.org/publications/series/

WIPO. (2024). Global Innovation Index [Dataset: UN, The World Intellectual Property Organisation]. https://www.wipo.int/en/web/global-innovation-index

World Bank. (2024a). Macro Poverty Outlook [Dataset]. http://documents.worldbank.org/curated/en/099345310142441749/

World Bank. (2024b). Worldwide Governance Indicators [Dataset]. https://www.worldbank.org/content/dam/sites/govindicators/

World Bank. (2025a). World Development Indicators [Dataset]. https://data.worldbank.org/

World Bank. (2025b). Worldwide Governance Indicators – Data Sources. https://www.worldbank.org/en/publication/worldwide-governance-indicators/

WTO. (2025). WTO Stats [Dataset: World Trade Organisation]. https://stats.wto.org/dashboard/merchandise_en.html

The Six GCC Economies:

|

|

|

|

|

|

| i | This is the website of Dr Emilie J. Rutledge who, with almost two decades’ worth of experience in managing, designing and delivering university-level economics courses, is currently Head of the Economics Department at The Open University.

erutledge.com  Dr Emilie J. Rutledge Emilie has published over 20 peer-reviewed papers and is the author of “Monetary Union in the Gulf.” Her current research focus is on employability, the feasibility of universal basic incomes and, the oil-rich Arabian Gulf’s economic diversification and labour market reform strategies. On an ad hoc basis, Emilie provides consultancy on developing interactive university courses, alongside analytical insight on the political-economy of the Arabian Gulf. |

Elsevier

Elsevier