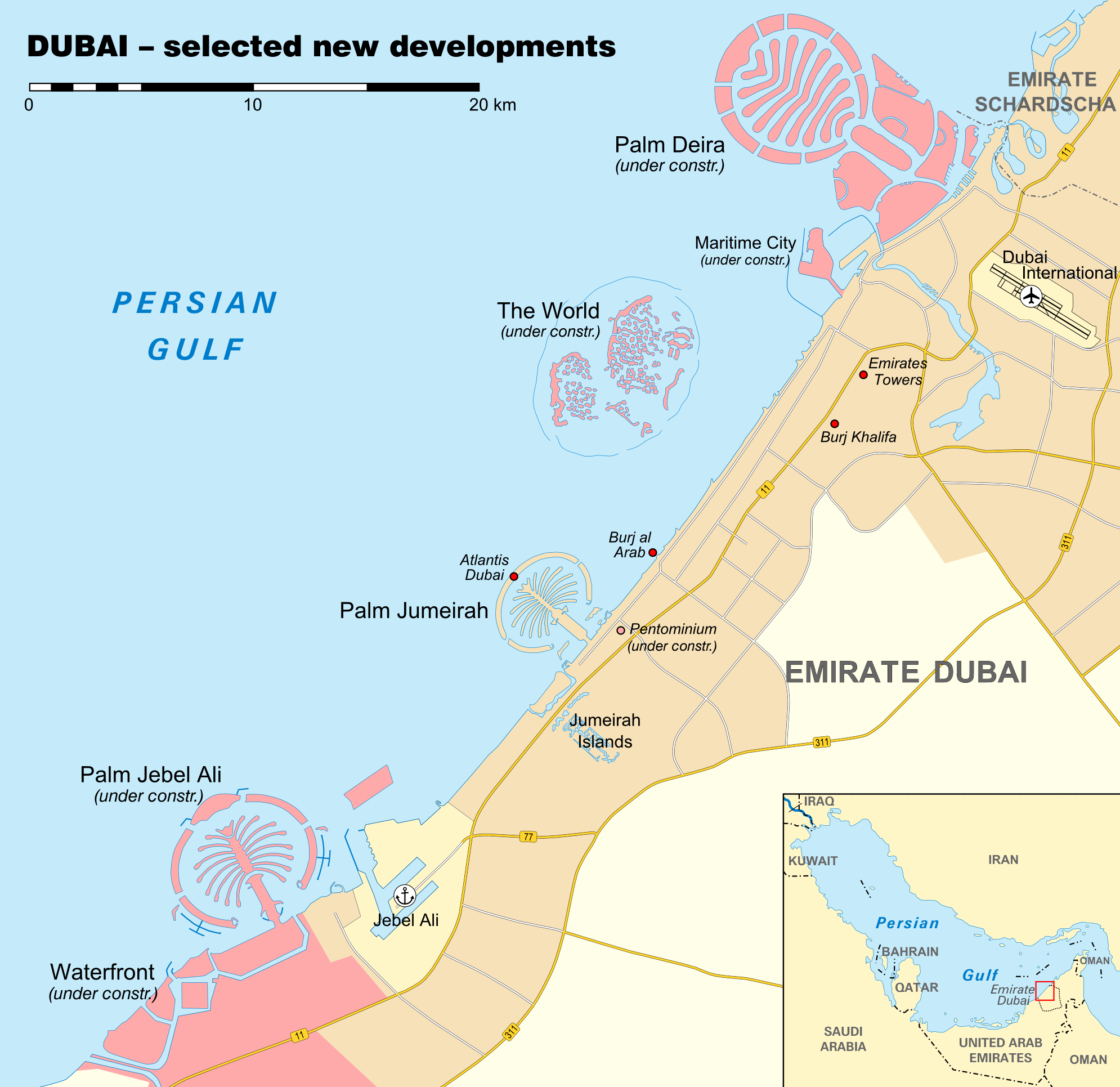

The UAE and Saudi Arabia are now in blatant competition with one another. Competition is healthy, many will contend and this can be true but, if and when the times are more difficult such competition could become cut throat.

According to Abuamer and Nassar (2023), “soft power acquisition can also be used to explain how Gulf states approach sports.” Soft power, as Nye (2004) set out explain how some states acquire influence in non-confrontational ways and that sports investments can be explained by intra-Gulf rivalries, where competition rather than cooperation between Gulf states is arguably a key driver.

References

Abuamer, M., & Nassar, Y. (2023, June 8). The Rise of Gulf States’ Investments in Sports: Neither Soft Power nor Sportswashing? The Project on Middle East Political Science (POMEPS). https://pomeps.org/the-rise-of-gulf-states-investments-in-sports-neither-soft-power-nor-sportswashing

Al Omran, A. (2025, January 6). World Cup award adds pressure to Saudi Arabia’s construction challenge. The Financial Times. https://www.ft.com/content/90eed648-a204-4058-b201-ff7a1bf7bb44

Baabood, A. (2023, October 30). The Future of the Gulf Cooperation Council Amid Saudi-Emirati Rivalry. Carnegie Middle East Center. https://carnegieendowment.org/research/2023/12/the-future-of-the-gulf-cooperation-council-amid-saudi-emirati-rivalry

Mason, R. (2023, June 23). How regime security is set to dominate Saudi-UAE interaction over economic competition and political rivalry. Atlantic Council. https://www.atlanticcouncil.org/blogs/menasource/saudi-arabia-uae-regime-security/

Foreman, C. (2022, November 29). Crown prince launches Riyadh airport masterplan. Middle East Economic Digest. https://www.meed.com/crown-prince-launches-riyadh-airport-masterplan

Foreman, C. (2022, December 7). Saudi Arabia plans 2km megatall tower in Riyadh. Middle East Economic Digest. https://www.meed.com/riyadh-plans-2km-megatall-tower

Foreman, C. (2024, March 5). Foster & Partners wins 2km-tall tower. Middle East Economic Digest. https://www.meed.com/foster-partners-wins-2km-tall-tower

Gridin, K. (2023, May 21). UAE and Saudi Arabia: Competition driving GCC growth. Vision Business Development. https://www.visionbusinessdevelopment.com/post/uae-and-saudi-arabia-competition-driving-gcc-growth

Kalin, S. (2023, November 25). Gaza Diplomacy Cements Qatar’s Global Mediator Role. Wall Street Journal. https://www.wsj.com/world/middle-east/gaza-diplomacy-cements-qatars-global-mediator-role-29e0ffb7

Milton, S., Elkahlout, G., & Tariq, S. (2023). Qatar’s evolving role in conflict mediation. Mediterranean Politics, 0(0), 1–25. https://doi.org/10.1080/13629395.2023.2266665

Nye, J. S. (2004). Soft Power: The Means To Success In World Politics. PublicAffairs.

Reisinezhad, A., & Bushehri, M. (2024, January 25). The Hidden Rivalry of Saudi Arabia and the UAE. Foreign Policy. https://foreignpolicy.com/2024/01/25/the-hidden-rivalry-of-saudi-arabia-and-the-uae/

The Economist. (2024, September 28). What “supertall” skyscrapers reveal about the countries that build them. The Economist, 452(9416), 75–76. Retrieved from https://www.economist.com/interactive/culture/2024/09/20/what-supertall-skyscrapers-reveal-about-countries-that-build-them