Sections

Arabian Gulf Sovereign Wealth Funds

On the mega and giga scale

Will winner take all?

This page considers oil-rent (“resource wealth”). It is of three parts.

Arabian Gulf sovereign wealth

from natural resources

Land, land, land

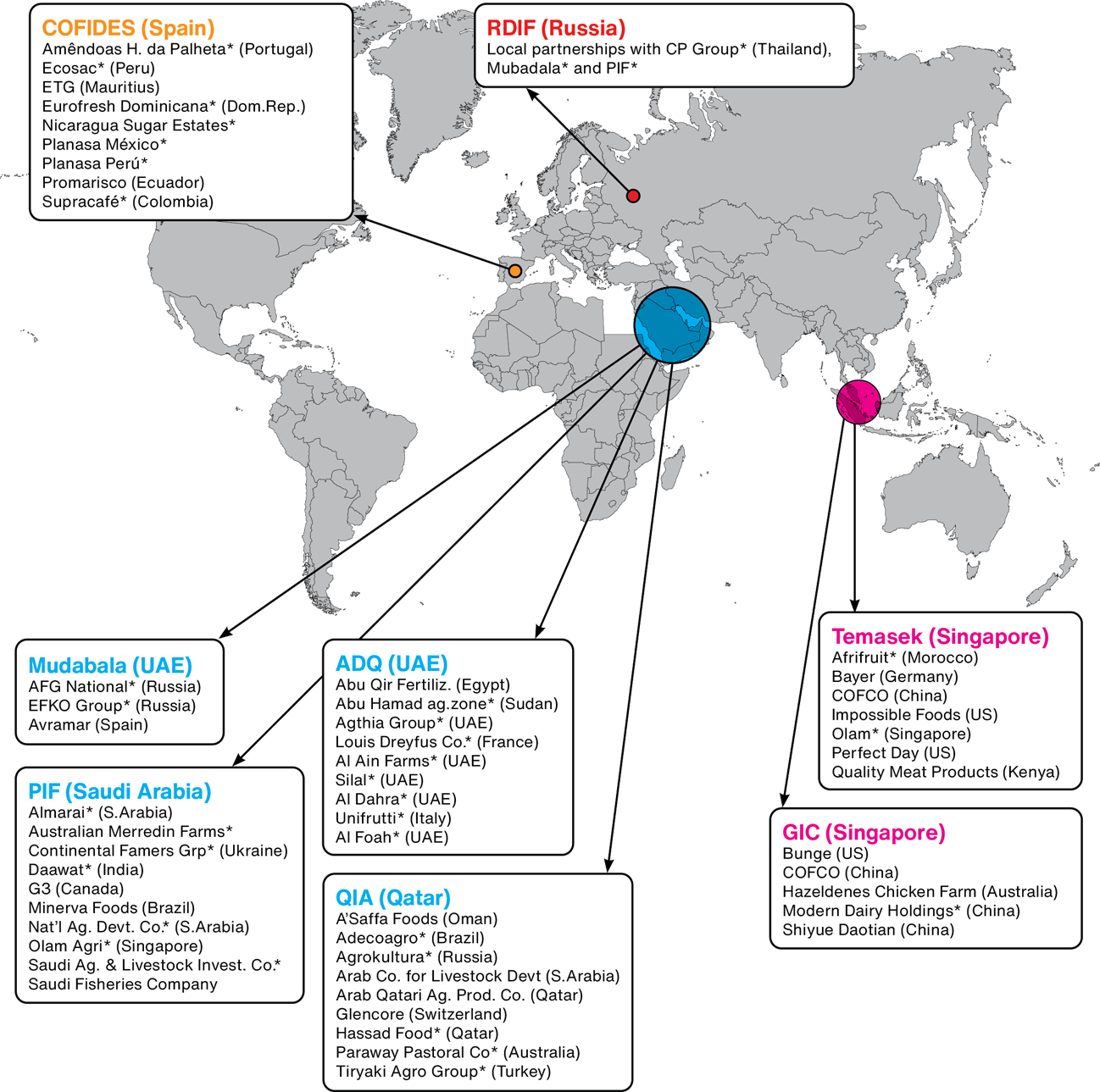

According to the Non-governmental organisation GRAIN (2023), in dollar terms, food and agriculture represent just two to three per cent of all SWF investments and, while that sounds small, “it is a politically sensitive and strategic sector for many governments.” Indeed, contributing to national food security has been a historic role for sovereign funds, and it is “a vital one for those of Singapore and the Gulf states.” A handful of SWFs form the centre of gravity for this mode of investing (see map below)

SWF land and food investments

Allocating oil-rent (“resource wealth” matters)

📕 “The Arabian Gulf Social Contract” →

📕 “Arabian Gulf sovereign wealth” →

London, the 8th Emirate

Both the UK and the USA have balanced their books over the past half century and when oil prices shot up rapidly in the 1970s the flow of Saudi capital into the west (a) be it to purchase—and bankroll the western world’s military industrial complex—armaments and equipment or (b), to purchase their government debt has more than compensated. UK and US oil companies have played hugely significant roles in the region and even if less so now, did shape many of these countries to be highly resource export orientated and dependent.

Saudi Arabia is the UK’s leading strategic ally and arms customer in the Middle East and the UK government has been signing “enormous arms export deals with the Saudis for fleets of combat aircraft, together with supporting infrastructure, and for the ongoing provision of maintenance, components and ammunition” since the 1970s onwards (Wearing, 2016, p. 5).

As Wong (2016) tells it, In the summer of 1974, the then US Treasury secretary, and his deputy stepped onto an 8 a.m. flight from Andrews Air Force Base headed towards Arabia. On board, the mood was tense. That year, the oil crisis had hit home. An embargo by OPEC’s Arab nations had quadrupled oil prices. Inflation soared, the stock market crashed, and the US economy was in a tailspin. The real mission, kept in strict confidence within President Richard Nixon’s inner circle, would take place in Jeddah. The objective was to neutralise crude oil as an economic weapon (for the American dollar denominated economy at least) and find a way to persuade Saudi Arabia to ‘fund’ America’s widening deficit with its newfound petrodollar wealth (Wong. 2016).

More than a quarter of the UK’s total £2.3 trillion debt pile is foreign-owned, according to the Office for Budget Responsibility.

Sports washing

Bahrain has long since hosted an annual F1 Race, the UAE famously hosts the world’s richest horse race—there is too the popular national sport of camel racing—but Qatar really put the Arabian Gulf on the sporting map by hosting the 2022 FIFA World Cup. (Beaumont, 2024; Liew, 2020; Morgan, 2020; T. Morgan, 2024; Panja, 2023, 2024; Paul, 2024; The Economist, 2023)

As Panja (2023) writes, “On Oct. 31, after an expedited process that caught its own members by surprise, FIFA confirmed Saudi Arabia was the sole bidder for the 2034 World Cup. Within hours, Mr. Infantino implied in a social media post that its status as host was a done deal and other Gulf rulers hailed it an “Arab victory” … His efforts were hardly clandestine. But they have left many in soccer concerned about Mr. Infantino’s motivations and questioning if he is using his position to prioritise FIFA’s interests or those of a friendly partner that has been leveraging its wealth to wield influence in the sport.”

Like the UAE, Saudi Arabia now plans to host a world EXPO, like Qatar, Saudi Arabia now plans to host the 2034 FIFA World Cup. Like Qatar and the UAE, Saudi Arabia has now invested in the European football clubs.

The Gulf states’ particular interest in European football clubs stems from these teams’ significant financial performance determined by liquidity, leverage, and sporting performance. European football clubs are increasingly profitable businesses. Among the top twenty European football clubs , Gulf countries invested in at least eight: the UAE invested in Manchester City, Real Madrid, Manchester United, Arsenal F.C., and AC Milan; and Qatar invested in FC Barcelona, Bayern Munich, and Paris Saint-Germain. The Gulf states’ investment in sports, especially in European football, represents a remarkable economic opportunity, as well as the more symbolic benefits of nation branding (Abuamer & Nassar, 2023).

On the giga-scale

Arabian Gulf Sovereign Wealth Funds

On the mega and giga scale

Will winner take all?

Not to be confused with white elephants

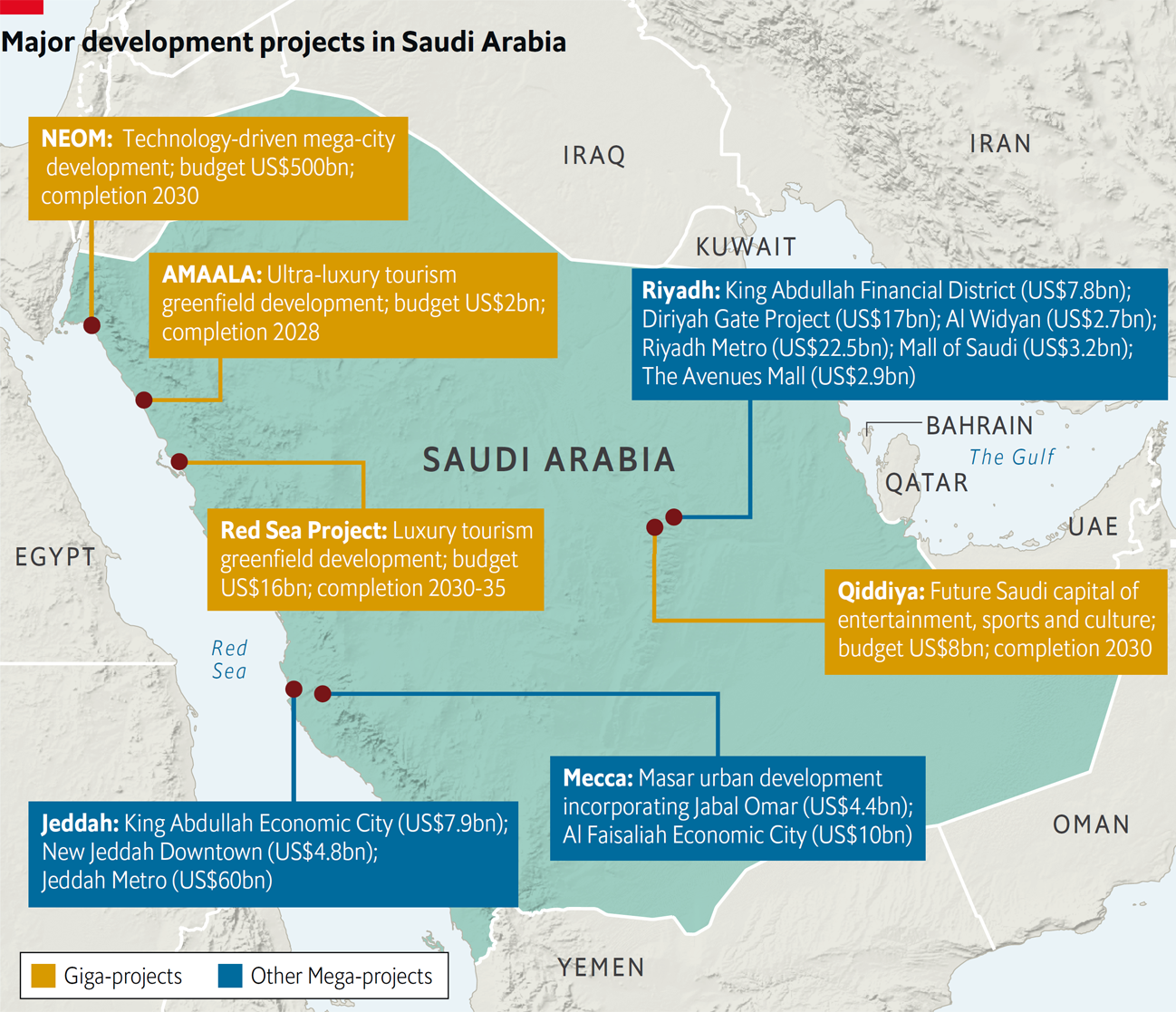

Accompanying the above graphic, The Economist Intelligence Unit writes, “Saudi Arabia has embarked on four transformative “giga projects” (including NEOM, a planned mega-city; and Qiddiya, a planned “entertainment city”) that represent major technology, tourism, real-estate, sport, cultural and entertainment developments aligned with Vision 2030 objectives. Saudi Arabia also intends to “develop national and international connectivity through ventures funded by a combination of state and foreign investment.”

NEOM

Football too

Will winner take all?

Arabian Gulf Sovereign Wealth Funds

On the mega and giga scale

Will winner take all?

The UAE and Saudi Arabia are now in blatant competition with one another. Competition is healthy, many will contend and this can be true but, if and when the times are more difficult such competition could become cut throat.

According to Abuamer and Nassar (2023), “soft power acquisition can also be used to explain how Gulf states approach sports.” Soft power, as Nye (2004) set out explain how some states acquire influence in non-confrontational ways and that sports investments can be explained by intra-Gulf rivalries, where competition rather than cooperation between Gulf states is arguably a key driver.

Endnotes

[01]

Segment of a mural by Elihu Vedder named “Government.” It is in the Lobby to Main Reading Room, Library of Congress Thomas Jefferson Building, Washington, D.C. (1896). It was photographed in 2007 by Carol Highsmith who commendably and explicitly placed the photograph in the public domain.

[02]

Qatar National Museum, under construction in Doha.

[03]

Louvre, Abu Dhabi Museum, close to completion in the UAE.

[04]

An international tennis championship taking place in Abu Dhabi under the sponsorship of one of the UAE’s Sovereign Wealth funds: Mubadala.

[05]

Three key funds: Qatar’s Qatar Investment Authority, the UAE’s Mubadala and Saudi Arabia’s Public Investment Fund.

[06]

MBS, with the money from Saudi Aramco the Government of Saudi Arabia has invested substantial sums into American companies and too, Japanese ones. On the right is : “White Center (Yellow, Pink and Lavender on Rose)” by Mark Rothko (1950). The painting is structured vertically, starting with a yellow horizontal rectangle at the top, a black horizontal strip, a narrow white rectangular band and the bottom half is lavender. The top half of the rose ground is deeper in colour and the bottom half is pale. It measures 205.8 × 141 cm. The work was sold in May 2007 by Sotheby’s on behalf of the Rockefeller family to the royal family of Qatar. The painting sold for $73 million, then setting the record of the current most expensive post-war work of art sold at auction.

[07]

“When Will You Marry?” by Paul Gauguin (1882) Oil on canvas (39.7 by 30.3 inches). Purchased by Qatar in 2015. “Eight Elvises” by Andy Warhol (1963) Silkscreen painting (6.5 by 12 feet). In 2008 it was sold for $100 million to the state of Qatar (most probably).

[08]

A visitor takes a photo of the painting Salvator Mundi by Leonardo da Vinci at Christie’s New York auction house. Photograph: Drew Angerer/Getty Images

[09]

“The Card Players” by Paul Cézanne (1892–93). Oil on canvas (97 by 130 centimetres). The Card Players is a series of five oil paintings by the French Post-Impressionist artist Paul Cézanne. One version of The Card Players was sold in 2011 to the Royal Family of Qatar for a price estimated at $250 million. It was the highest ever price for a painting, not surpassed until November 2017. To the right is “Salvator Mundi” by Leonardo da Vinci (c. 1499–1510), Oil on walnut panel (25.8 by 19.2 inches). Acquired by Mohammad bin Salman. The painting was sold at auction for US$450 million on 15 November 2017 by Christie’s in New York to Prince Badr bin Abdullah Al Saud, setting a new record for the most expensive painting ever sold at public auction. Although Prince Badr allegedly made the purchase on behalf of Abu Dhabi’s Department of Culture and Tourism. However, it was later reported that he was a stand-in bidder for the Saudi Arabian Crown Prince Mohammed bin Salman.

[10]

“La Montagne Sainte-Victoire vue du bosquet du Château Noir” by Paul Cézanne (1904). Oil on canvas (25.5 by 31.6 inches).

[11]

The Kuwait Investment Authority headquarters, Kuwait City.

[12]

The completed national museum of Qatar, Doha.

[13–15]

Three photographs of the completed Louvre museum, Abu Dhabi.

References

Abuamer, M., & Nassar, Y. (2023, June 8). The Rise of Gulf States’ Investments in Sports: Neither Soft Power nor Sportswashing? The Project on Middle East Political Science (POMEPS). https://pomeps.org/the-rise-of-gulf-states-investments-in-sports-neither-soft-power-nor-sportswashing

Adam, G. (2014, October 21). Qatar: Contemporary art’s biggest buyer. BBC. https://www.bbc.com/culture/article/20131021-qatar-the-art-worlds-big-fish

Agini, S., & Cornish, C. (2024, November 28). Qatar wealth fund to take stake in Audi Formula One team. The Financial Times. https://www.ft.com/content/735c3eef-5e88-4185-864c-96480baeb584

Al Omran, A., & Levingston, I. (2024, October 29). Saudi Arabia’s wealth fund pivots from international investments. The Financial Times. https://www.ft.com/content/5004fbc6-23e2-4b9f-9885-14e1ea724ce2

Al Omran, A. (2025, January 6). World Cup award adds pressure to Saudi Arabia’s construction challenge. The Financial Times. https://www.ft.com/content/90eed648-a204-4058-b201-ff7a1bf7bb44

Baabood, A. (2023, October 30). The Future of the Gulf Cooperation Council Amid Saudi-Emirati Rivalry. Carnegie Middle East Center. https://carnegieendowment.org/research/2023/12/the-future-of-the-gulf-cooperation-council-amid-saudi-emirati-rivalry

Barzani, H. (2022, April 4). Many European soccer teams are owned by Gulf states. But why? Atlantic Council. https://www.atlanticcouncil.org/blogs/menasource/many-european-soccer-teams-are-owned-by-gulf-states-but-why/

Beaumont, P. (2024, April 10). Saudi Arabia wants to top its linear city with a sci-fi soccer stadium. The Guardian. https://www.theguardian.com/world/2024/apr/10/the-line-saudi-arabia-scaling-back-plans-105-mile-long-desert-megacity-crown-prince

Calabrese, J. (2023, January 12). The new wave of dealmaking by Gulf sovereign wealth funds. Middle East Institute. https://www.mei.edu/publications/new-wave-dealmaking-gulf-sovereign-wealth-funds

Dempsey, H., & Cornish, C. (2024, April 1). How Gulf states are putting their money into mining. The Financial Times. https://www.ft.com/content/59298650-540a-43cd-86f8-a6c6db0aa906

EIU. (2021). Are Saudi Arabia’s plans to become the main business hub for the Middle East achievable or a step too far? The Economist Intelligence Unit. https://www.eiu.com/public/topical_report.aspx?campaignid=may21saudiwp

England, A. (2023, December 11). Qatar’s $500bn wealth fund targets bigger deals as LNG windfall looms. The Financial Times. https://www.ft.com/content/719096eb-6e82-490a-91a4-15e09e042e4f

England, A. (2024, August 19). Middle East states set for $1.3tn oil windfall, says IMF. The Financial Times. https://www.ft.com/content/94825404-e0a2-4a18-ab8d-2bc61fc7c1ab

England, A., Cornish, C. & Masters, B. (2024, August 19). Saudi wealth fund brings era of easy money to an end. The Financial Times. https://www.ft.com/content/e22b512e-f5c0-43d8-86ce-a9e014aa4e55

England, A., Kerr, S., & Al-Atrush, S. (2024, January 4). The new Gulf sovereign wealth fund boom. The Financial Times. https://www.ft.com/content/33a985a5-6955-4f44-869f-82e82e620581

Foreman, C. (2022, November 29). Crown prince launches Riyadh airport masterplan. Middle East Economic Digest. https://www.meed.com/crown-prince-launches-riyadh-airport-masterplan

Foreman, C. (2022, December 7). Saudi Arabia plans 2km megatall tower in Riyadh. Middle East Economic Digest. https://www.meed.com/riyadh-plans-2km-megatall-tower

Foreman, C. (2024, March 5). Foster & Partners wins 2km-tall tower. Middle East Economic Digest. https://www.meed.com/foster-partners-wins-2km-tall-tower

GRAIN. (2024, April 6). Will more sovereign wealth funds mean less food sovereignty? GRAIN. https://grain.org/en/article/6976-will-more-sovereign-wealth-funds-mean-less-food-sovereignty

Gridin, K. (2023, May 21). UAE and Saudi Arabia: Competition driving GCC growth. Vision Business Development. https://www.visionbusinessdevelopment.com/post/uae-and-saudi-arabia-competition-driving-gcc-growth

Kalin, S. (2023, November 25). Gaza Diplomacy Cements Qatar’s Global Mediator Role. Wall Street Journal. https://www.wsj.com/world/middle-east/gaza-diplomacy-cements-qatars-global-mediator-role-29e0ffb7

Klasa, A., England, A., & Kerr, S. (2022, July 19). Inside the Kuwait Investment Authority: ‘It’s chaos there now’. The Financial Times. https://www.ft.com/content/e2d7b536-c4c6-49ee-9a2c-63d6a81cff0f

Liew, J. (2020, May 28). Newcastle United fans back the club’s takeover by Saudi Arabia. Do they bear moral responsibility? New Statesman, 149(5521), 40. https://www.newstatesman.com/culture/sport/2020/05/newcastle-fans-back-club-s-takeover-saudi-arabia-do-they-bear-moral

MacInnes, P. (2023, August 12). ‘It’s not a fad’: the truth behind Saudi Arabia’s dizzying investment in sport. The Guardian. https://www.theguardian.com/football/2023/aug/12/its-not-a-fad-the-truth-behind-saudi-arabias-dizzying-investment-in-sport

Mason, R. (2023, June 23). How regime security is set to dominate Saudi-UAE interaction over economic competition and political rivalry. Atlantic Council. https://www.atlanticcouncil.org/blogs/menasource/saudi-arabia-uae-regime-security/

Milton, S., Elkahlout, G., & Tariq, S. (2023). Qatar’s evolving role in conflict mediation. Mediterranean Politics, 0(0), 1–25. https://doi.org/10.1080/13629395.2023.2266665

Morgan, T. (2020, June 28). The complex relationship between Saudi Arabia and UAE that could soon shape the Premier League, Article. The Daily Telegraph. https://www.telegraph.co.uk/football/2020/06/28/special-report-complex-relationship-saudi-arabia-uae-could-soon/

Morgan, T. (2024, January 30). Saudi fury at criticism from Martina Navratilova and Chris Evert. The Telegraph. https://www.telegraph.co.uk/tennis/2024/01/30/saudi-fury-criticism-martina-navratilova-chris-evert

Nye, J. S. (2004). Soft Power: The Means To Success In World Politics. PublicAffairs.

Olech, A. (2024, September 14). Emirati dominance – takeovers of more ports in Africa. Defence 24. https://defence24.com/geopolitics/emirati-dominance-takeovers-of-more-ports-in-africa

Panja, T. (2023, 17 October). Inside Man: How FIFA Guided the World Cup to Saudi Arabia, Article. New York Times. https://www.nytimes.com/2023/11/15/world/middleeast/saudi-arabia-fifa-world-cup.html

Panja, T. (2024, June 13). Saudis Poured Cash Into Golf. Boxing Is Next. The New York times. https://www.nytimes.com/2024/06/12/world/middleeast/saudi-boxing-league.html

Paul, A. (2024). Saudi Arabia wants to top its linear city with a sci-fi soccer stadium. Popular Science. https://www.popsci.com/technology/saudi-arabia-soccer-stadium/

Reisinezhad, A., & Bushehri, M. (2024, January 25). The Hidden Rivalry of Saudi Arabia and the UAE. Foreign Policy. https://foreignpolicy.com/2024/01/25/the-hidden-rivalry-of-saudi-arabia-and-the-uae/

Ruehl, M. (2023, December 6). Gulf funds increase investment in south-east Asia as China retreats. The Financial Times. https://www.ft.com/content/32689e73-acd0-4ed2-89ac-7f58110662fa

Salih, T. (2024, May 26). The New Scramble for Africa: Land Acquisitions, Modern Imperialism, and the Role of the UAE. Medium. https://medium.com/@taisalih/the-new-scramble-for-africa-land-acquisitions-modern-imperialism-and-the-role-of-the-uae-d8e4505f5fd6

The Economist. (2023). Scoring political goals. The Economist, 448(9358), 18–20. https://www.economist.com/briefing/2023/08/10/saudi-arabia-is-spending-a-fortune-on-sport

The Economist. (2024, September 28). What “supertall” skyscrapers reveal about the countries that build them. The Economist, 452(9416), 75–76. Retrieved from https://www.economist.com/interactive/culture/2024/09/20/what-supertall-skyscrapers-reveal-about-countries-that-build-them

TRT World. (2021, May 8). Gulf ownership of UK assets raise questions over undue influence. TRT World. https://www.trtworld.com/magazine/gulf-ownership-of-uk-assets-raise-questions-over-undue-influence-45908

Wearing, D. (2016). A shameful relationship: UK complicity in Saudi state violence. Campaign Against Arms Trade. https://caat.org.uk/publications/a-shameful-relationship-uk-complicity-in-saudi-state-violence/

Wong, A. (2016, June 1). The untold story behind Saudi Arabia’s 41-year secret debt. The Independent. https://www.independent.co.uk/news/business/news/the-untold-story-behind-saudi-arabia-s-41year-us-debt-secret-a7059041.html

Worth, R. F. (2021, January 28). The Dark Reality Behind Saudi Arabia’s Utopian Dreams: Screenland. New York Times. https://www.nytimes.com/2021/01/28/magazine/saudi-arabia-neom-the-line.html

| i | This is the website of Dr Emilie J. Rutledge who, with almost two decades’ worth of experience in managing, designing and delivering university-level economics courses, is currently Head of the Economics Department at The Open University.

erutledge.com  Dr Emilie J. Rutledge Emilie has published over 20 peer-reviewed papers and is the author of “Monetary Union in the Gulf.” Her current research focus is on employability, the feasibility of universal basic incomes and, the oil-rich Arabian Gulf’s economic diversification and labour market reform strategies. On an ad hoc basis, Emilie provides consultancy on developing interactive university courses, alongside analytical insight on the political-economy of the Arabian Gulf. |